Seven years is a very long time to try and predict into the future. Most new businesses do not attempt to project that far out. Normally it is just 3 years. 5 years at most.

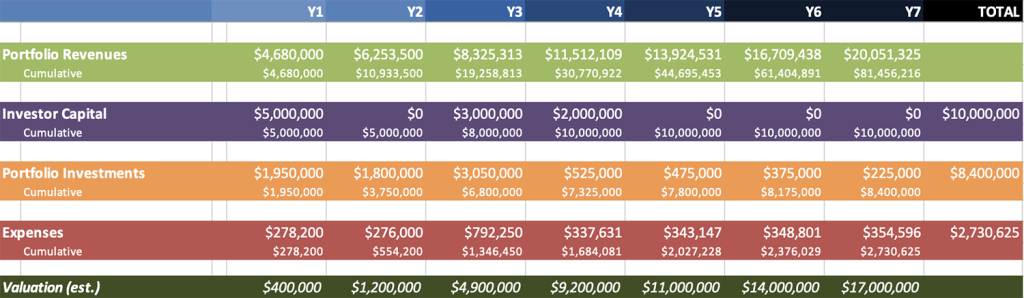

In the latest quarterly report, Luni Libes (CEO) took a look back at the very first financial model, built back in August 2018, seven years and two months ago.

If Y1 is 2018, then Y7 is 2024, which means that we can actually compare these Y7 projections with the actual end of year result for 2024. So how did we do?

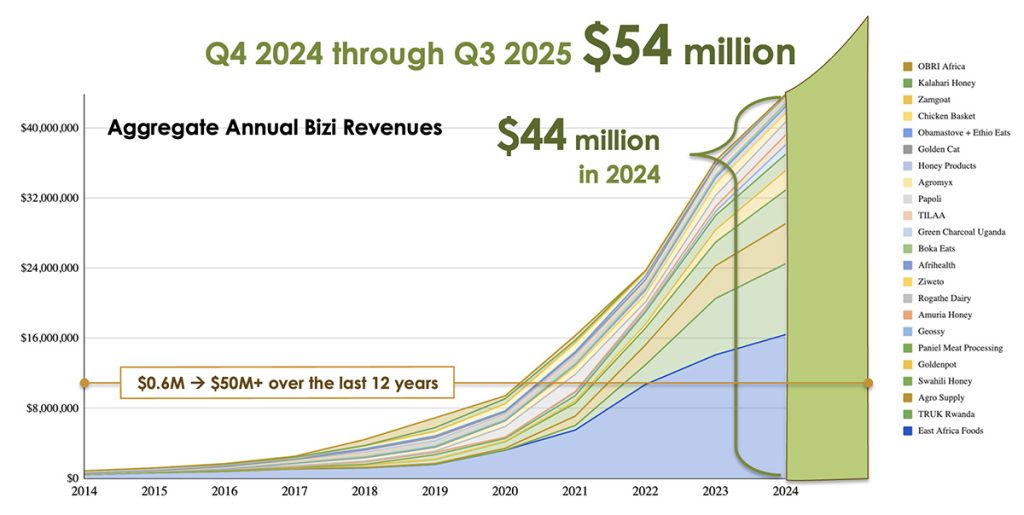

- 2024 Portfolio Revenues were $44 million, more than twice the projected $20 million

- Total capital raised was $14 million, higher than the projected $10 million, but spread out more evenly and more importantly, not enough more to explain the 2.2x higher revenues

- Total portfolio investments were around $11 million, again higher than projected but again spread out far more evenly over the years

- Usually not only are revenues overly optimistic on these financial models, but usually expenses are also grossly underestimated. Not here. Total revenues have been close to the $2.7 million projections

- Most importantly, how much value has been created? 2024 ended with a valuation of $24 million, 40% higher than the projected $17 million

Overall, quite accurate for a financial model based on a novel business model, in a market with few other investors to look to as benchmarks.

The key lesson from looking backwards is to help provide some insights as we look forward into the 2030s. The above model “reasonably” predicted a 4.25x growth in revenues over seven years. Most every investor we talked to in 2018 and 2019 (all of which passed on the opportunity) thought we were being overly optimistic.

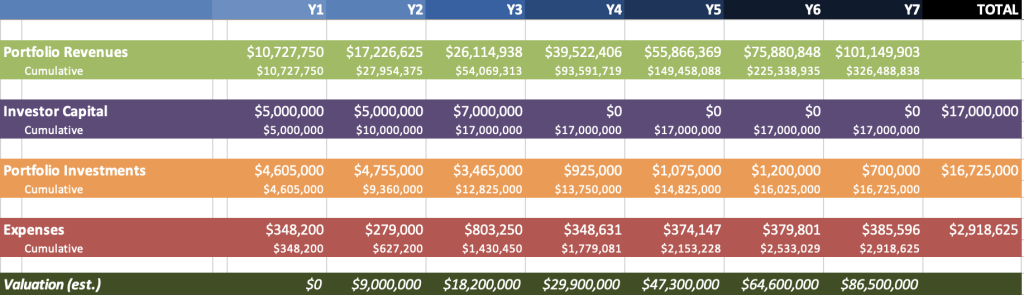

Africa Eats launched in mid-2020, and by then the financial model had been updated to the one seen above. Here Y1 = 2020 and Y4 = 2024. Again, the model was low on revenues (but not as low), a little high on investor capital, and short on valuation (by just about the amount we were short on investor capital). Overall, not too far off predicting four years into the future.

How about 2025? There is still two and an half months left to see where the 2025 annual results finish, but what we do know is that the aggregate portfolio revenues for Q4 2024 through Q3 2025 were $54 million. And that Q4 is usually a good quarter for growth. So it looks like we’ll beat the $55.8 million predicted back in 2020.

And thus while it seems like $101 million total revenues in 2027 is overly optimistic, that is only now two years away. Given reality has beaten the seemingly optimistic but in hindsight overly conservative values, it does in fact seem possible that the portfolio revenues will indeed surpass that $100 million milestone in 2027. And if not for the calendar year 2027, then likely for the trailing four quarters in 2028 (which seems far away but we’re now closer to 2030 than 2020).