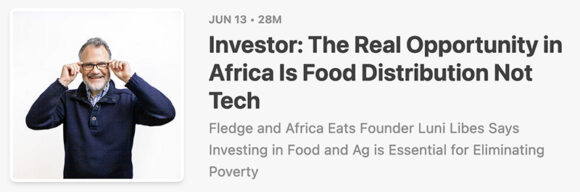

Luni and Jumaane, the co-founders of Africa Eats have published a book, “Berkshire Africa” that explains how our unique investment company has applied the learnings of venture capital, business accelerators, and Berkshire Hathaway toward solving hunger and poverty across Africa. We’ve explained this before, in brief, but now have a 160-page book with far more details, including...