African stock exchanges are notoriously illiquid. It is not uncommon on the Stock Exchange of Mauritius for 1/3rd of the companies to have no trades at all.

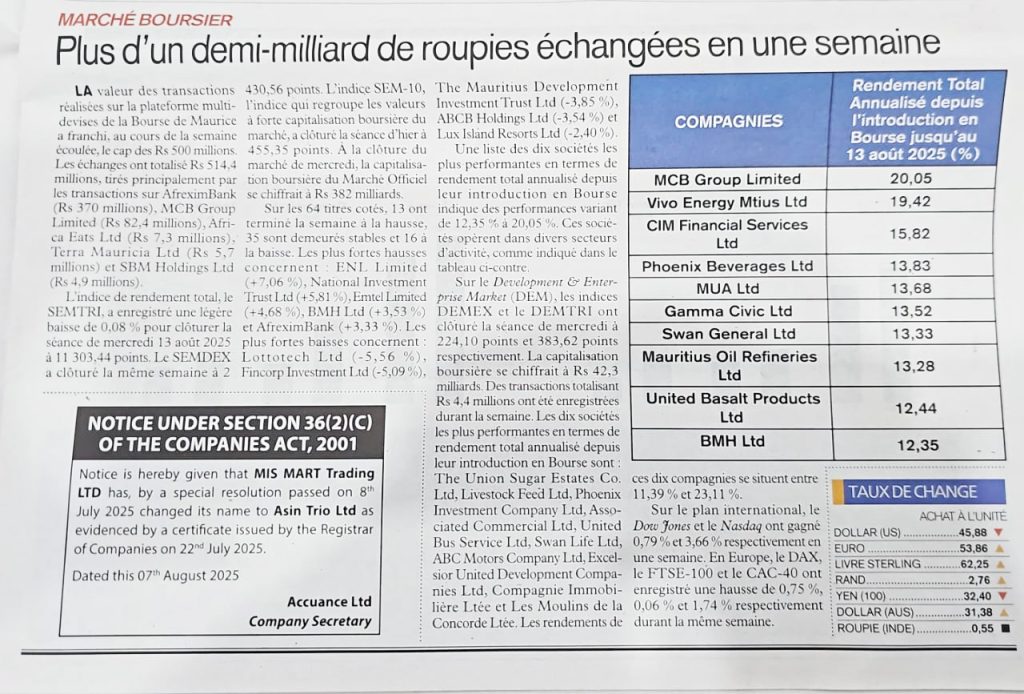

Which is why Tuesday Markets was created, to create liquidity in African markets, starting with registering as a market maker for EATS, ELIT and ZWTO. And that effort is working. Below is an article from a Mauritian business magazine talking about the volume of trading from the previous week.

The most traded stock was AfreximBank, the African Import-Export Bank followed by MCB Group, which operates the largest bank on the island. Then third was Africa Eats, whose market cap is 15% the size of Afrexim and 1% the size of MCB. Africa Eats traded more shares than 8 of the 10 largest companies on the stock exchange, and the difference and drive of that volume was our registered market maker, Tuesday Markets.

Having that market maker gives our shareholders confidence that they can sell whenever they need to sell. And some have done just that, while new shareholders buy their shares, all mediated by Tuesday Markets so that the buyers and sellers don’t need to find each other and don’t need to match up on the same day in order for those trades to settle.

Also helping with this volume is the Tuesday app, which let investors buy and sell shares of EATS, ELIT and ZWTO from their phones, tablets, and notebooks.