Impact investing is not one thing, it’s a continuum of tradeoffs between impact and return on investment. At least sometimes. In the leftmost graph below, the top left corner is Wall Street-style investing, aiming to maximize returns with little to no regard for impact. The bottom right corner is philanthropy, maximizing impact with no returns. Everything in between is impact investing (middle graph). Looking at the four quadrants:

The Wall Street crowd has shifted to impact via ESG, which is better than nothing, but not solving hunger, poverty, climate, or any other major issue. Meanwhile, the philanthropists who have woken up to impact investing are doing so with concessionary returns, doing good but not attracting sufficient capital to solve the big issues.

The top right corner is where investors have their cake, achieving high impact and high returns. If you plot Africa Eats on this continuum, it belongs near the top right corner. Why?

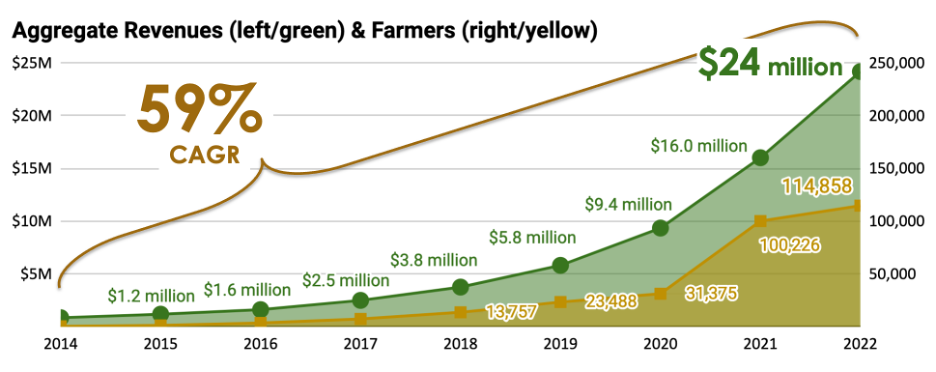

As of the end of 2022 the portfolio companies (a.k.a. the “bizi”) were working with over 114,000 smallholder farmers, on average doubling their income. That metric up from fewer than 1,000 in 2014! Concurrently, aggregate annual revenues have grown from under $1 million in 2014 to over $24 million for 2022, compounding at an average rate of 59%.

This is the type of growth more reminiscent of a venture capital fund, but Africa Eats has a very different business model. One that (in a few years) will provide higher returns than venture capital without anywhere near as much risk. All while continue to lessen hunger and directly end poverty for even more hundreds of thousands of smaller farmers and their families across Africa.

So not literally cake for investors, but as an impact investment, both high impact and high returns.