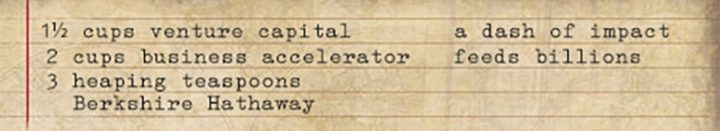

Africa Eats’ recipe is one cup venture capital fund, two cups business accelerator, and three heaping teaspoons of Berkshire Hathaway. Add in two dozen fast-growing, homegrown, bottom-up for-profit solutions to hunger and poverty across Africa. Stir vigorously. Feeds billions.

This isn’t some old family recipe. Neither is it the common way these things are done. But after looking at all the alternative structures, it seems the solution Africa has been waiting for.

Why not VC? Because the traditional venture capital path requires acquisitions, and that rarely happens in any industry in Africa. And because the traditional venture capital path burns through tremendous amounts of investor capital, wastefully searching for the next big thing when thousands of old good business models that could grow into national-scale, regional-scale, and pan-African scale are left unfunded.

Why not PE? Because the traditional private equity fund model doesn’t mesh well with young, energetic, homegrown, get-things-done entrepreneurs. PE funds fail to leverage the vision and dedication of founders, who saw some opportunity big enough to quit their job and build something new, who will see the next opportunities too if only given the incentives to keep their eyes open.

Why not a conglomerate? A common pattern in Africa (and Asia) is the family conglomerate, buying up whole companies and forming one big interconnected family of companies. This too doesn’t leverage the power of founders, and it doesn’t provide an easy path for outside investors to join in.

Why Berkshire Hathaway? Over the last half century, no investor in public and private companies has done better than Warren Buffett. Despite him sharing the lessons he’s learned at his annual shareholder meeting, few investors listen. We listened. If there is a company you like enough to invest, then invest in it and keep it forever. Don’t spend your time thinking about “flipping” it like a VC or PE fund. Don’t worry about control like a conglomerate. Let its management manage it, be a hands off owner as long as it is doing well, and put it in the portfolio to create a balance sheet that provides value to investors and as well as a lower cost of capital to all the companies therein.

So… unpacking the above recipe… find and invest in founders like the VCs do… buy a minority stake… provide guidance, support, and mentorship like a great business accelerator… and plan on holding those shares forever. Do that and you create a structure greater in value than the sum of the parts, with the added value the interactions that come from a growing network of founders who share a vision of a rich and prosperous Africa, who are working every day to make that a reality.