If you have to summarize Africa Eats into just seven words… Africa Eats helps quickly scale up SMEs. Give us more words and we’ll talk about investing in the food/ag supply chain, filling in the gaps of business infrastructure, and our progress ending hunger and poverty. But we do all that by helping SMEs scale up from tiny to millions in annual revenues.

Below are seven examples of what that looks like in real life. Seven companies that were tiny when we found them, which a few years later were earning over $1 million in annual revenues, and still growing.

We met Goldenpot at the end of 2019. The company was two years old. $24,000 in annual revenues. Working with 250 smallholder women farmers outside Arusha, Tanzania. Giving the farmers free seeds and inputs, aggregating the maize, and grinding it into maize flour. Four years later, the company still makes maize flour, but now also makes instant porridge and breakfast cereal, growing in 2023 past $1 million in annual revenues.

We met Ziweto Enterprise in 2016. Back then the company was three small agrovet shops in rural Malawi, each shop earning just $10,000 per year. By 2019 the company was the largest supplier of agrovet supplies in Malawi, selling vaccines, medicines, and other veterinarian supplies to other agrovet shops as well as operating 10 of their own stores. In 2022 the company built an animal feed factory. That year would have seen revenues over $1 million USD except for the 25% devaluation of the Malawi kwacha. Revenues will be over $1 million in 2023.

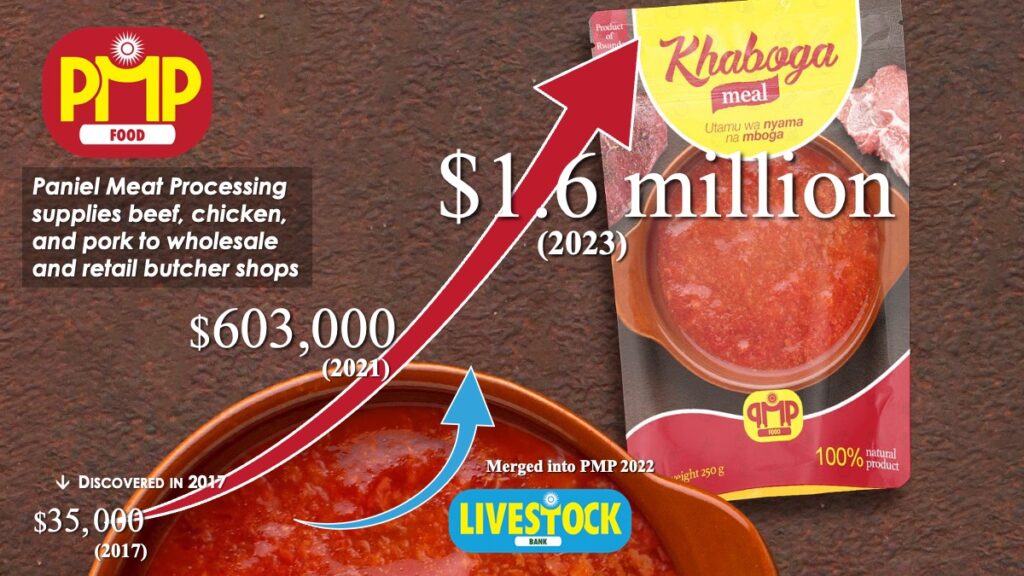

We met Paniel Meat Processing in 2017, when its equipment was just one hand-powered meat grinder and one hand-powered sausage stuffing machine. It was back then the fourth largest meat processing company in Rwanda, and six years later is still ranked fourth, but has grown to over $1.5 million in annual revenues. Along the way the founder created Livestock Bank to distribute animal husbandry to thousands of Rwandan smallholder farmers and merged that business into PMP in 2022.

We met Swahili Honey in the middle of 2018, one of the thousands of honey aggregators in Africa working with smallholder farmers. Five year later, few have grown as fast as this company. 10x in 5 years. On track to be the largest honey company in Tanzania. Well over $2 million in annual revenues. Exporting honey and beeswax around the world.

We met Agro Supply at the end of 2019, the end of its third year of operations. We were excited to see how their unique lay-a-way sales model worked and whether it would scale. 30x growth in four years. Over $3 million in annual revenues from just 30,000 smallholder farmers, with millions of similar farmers in Uganda yet to know about the company.

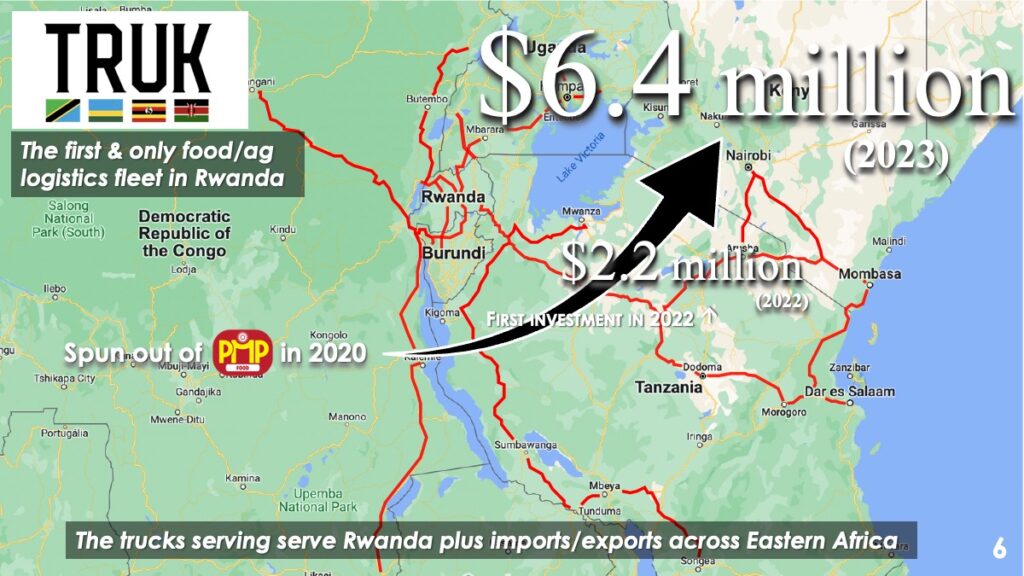

The founder of PMP (see above) saw an opportunity during the pandemic lockdowns of 2020, spinning up/out a food/ag refrigerated logistics company, TRUK. He bootstrapped it for the first two years before asking for any investment capital. Africa Eats invested just $200,000 at the start of 2022 and the revenues that year grew 4x to $2.2 million. A year later, revenues have grown almost 3x Y/Y, past $6 million.

The oldest of these companies is East Africa Foods, which we met in 2014 after their first year of business. $100,000 of annual revenues that year. Ten years later, in 2022, over $10 million. Growing 50% Y/Y in 2023, surpassing $15 million. 150x growth since we met them. All of these revenues from the outputs of over 10,000 smallholder farmers in Tanzania. Most of this from potatoes, onions, and bananas, plus a little from rice, beans, mangoes, and various other crops.

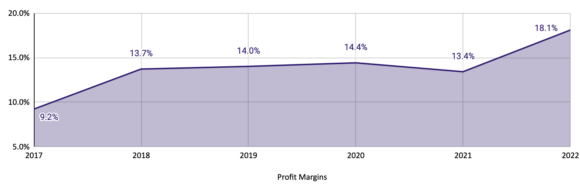

All of these companies are profitable, not just TRUK. All of these companies are capital efficient, spending less than $1 of investment capital per $1 of annual revenues. All of these companies are expected to continue growing 50%-100% Y/Y as all have enormous umet needs in their home countries, and then similar opportunities in their neighboring countries.

And finally, there are dozens more similar companies in the Africa Eats portfolio, and tens of thousands more that could follow this path too, if only for the types of investments and support that Africa Eats provides.