Africa Eats is not yet a year old, but the choice of holdco is already showing its benefits over a traditional venture capital fund.

Did you know the first-ever modern venture capital “fund” was not a fund, but a public holding company? American Research and Development. Boston. 1946.

The reason the limited partnership structure became the norm is that the founders of ARD didn’t create a sustainable business plan for their business. They instead took on all the costs of an investment bank, but without having any clients to charge investment banking fees. First-time entrepreneur rookie mistake. And no role models to emulate.

Africa Eats fixes this oversight in two ways. First, we started on Day 1 with a portfolio of investees. We thus had no costs for searching dealflow and doing due diligence. Second, to pay the cost of headquarters we run services that our bizi (a.k.a. investees) find useful. Lending is one of those services. The most interesting service this year is solar leases. Reliable, 100% renewable electricity, at a cost lower than the national grid. More news on that soon and more services to come in 2021.

The bigger flaw of ARD was that like every other VC, their goal was to get out of each investment as quickly as possible. Let me repeat that as it’s normal but from a step or two back, odd. From the day after they made the investment, their goal was to have someone else own the company. Sooner than later.

Africa Eats took a page and a lesson from Berkshire Hathaway. We like our bizi and have no plans on ever selling any of our shares in those companies. Ever.

With that, our short-term mindset is gone. With that we’re no longer looking for our bizi to grow so fast it burns out their founders. We’re not stuck on the Silicon Valley mindset of go big or go home. We’re instead thinking every day about how we can help our companies grow at a fast, but comfortable pace throughout the 2020s, and the 2030s, and onward to the 2050s.

This is why Africa Eats doesn’t look at our portfolio as 27 individual, separate companies but instead as 27 pieces of a greater whole. Sounds a bit cliche and corny, but while we do talk to each company separately about their needs, we just as often talk about what knowledge they have to share with others, what partnerships we can build together, and what common services might help all or most of the companies.

This manifests itself in our governance structure. We take two board seats from each company, not one. But Africa Eats management doesn’t sit in those seats. Instead we assigned the bizi founders to sit on each others’ boards. To learn from each other. To learn to be better managers. To share their knowledge directly with each other. To tell management what is needed instead of being told how to grow their own companies.

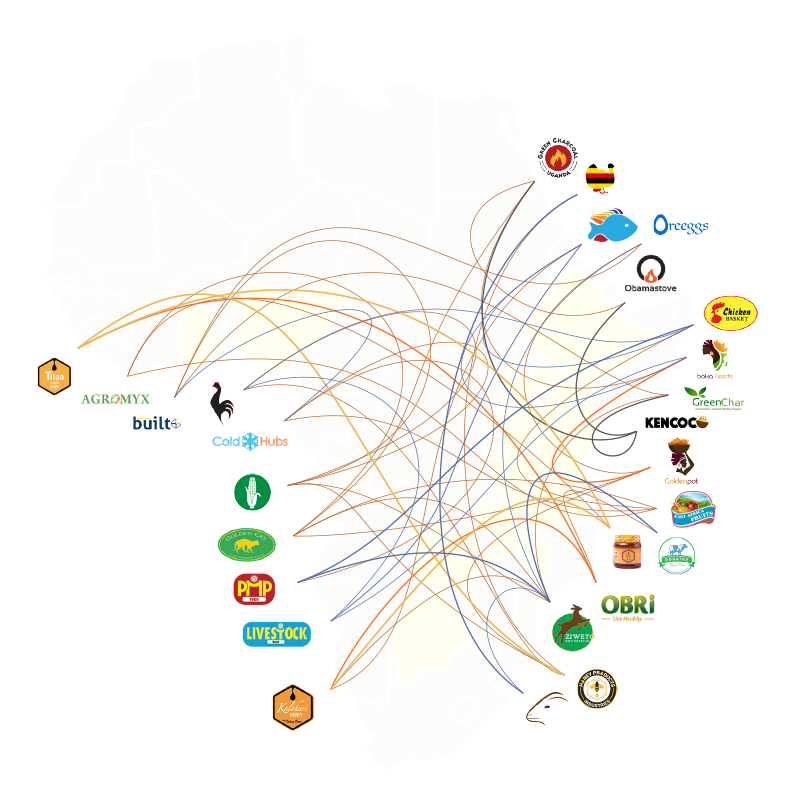

This structure creates a network effect. It makes the breadth of 27 companies located in 10 countries a benefit, not a burden. 27 founders, each sitting on two boards is 81 points of connection. As the founders shift from board to board each year, this effect grows further.

Above is the actual map of board seats for 2020. Looks complicated, doesn’t it? As a whole, maybe. From the point of view of any one founder, it’s not. Each company has a board with two other founders, and each founder sits on two boards. So for any given founder, there is no complexity, just a few more experienced entrepreneurial brains to help solve problems.

Overall, is this more complicated than a VC fund. Yes. But assigning boards and getting updates is less work than sitting on 27 boards.

Is this different? Absolutely. Different form most VCs, but not different from ARD, which was a big success, and not too different from Berkshire Hathaway, one of the most successful investors in the history of mankind.

This difference is why we believe the odds of success of Africa Eats are higher than a venture capital fund, higher than 27 separate companies making their way alone in the world, and why in a few years we expect others will be copying this model.

TL,DR; the investment holdco is the better structure.