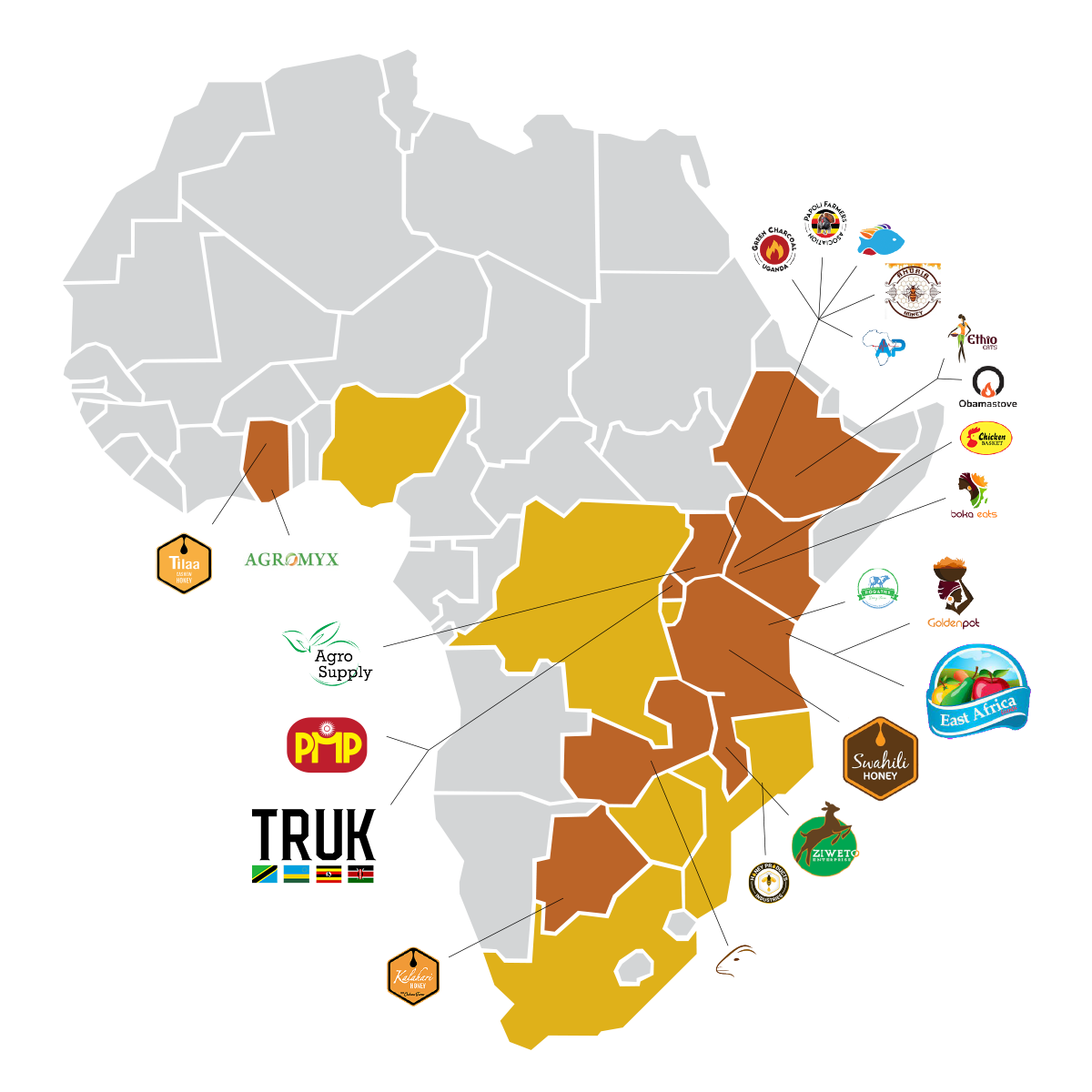

Africa Eats funds and supports for-profit solutions to hunger and poverty. We are capitalists, not philanthropists. But unlike most capitalists, we don’t hide from risk, seeking the safest returns, but instead follow the opportunities where few others are investing, seeking the biggest opportunities for growth and thus the biggest opportunities for returns. That is why we focus on food...