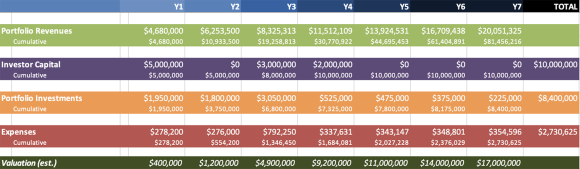

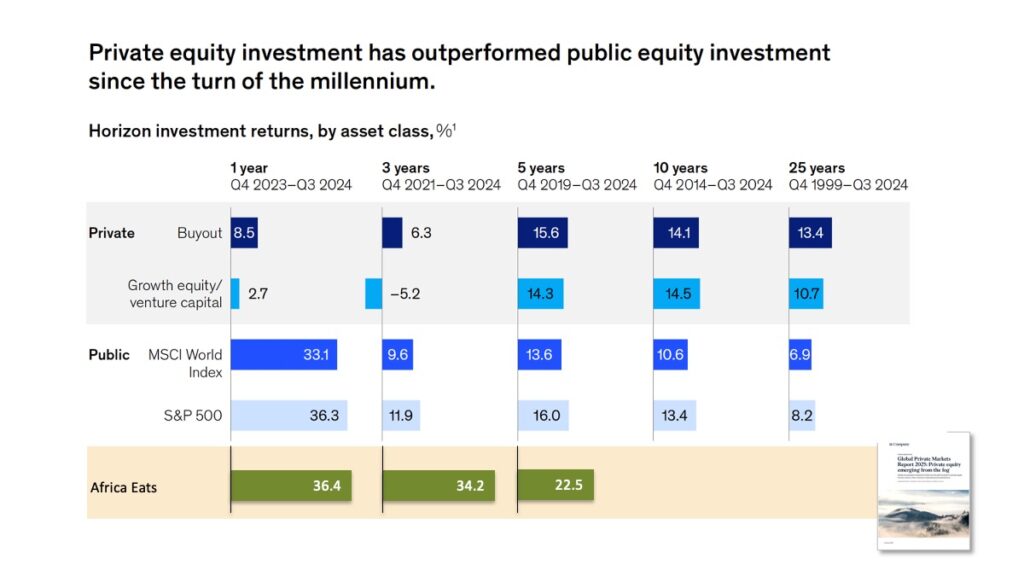

Africa Eats is now old enough to to benchmark our share price. We invest in young, fast-growing companies, so a good comparison would be the private equity (PE) and venture capital (VC) funds. But Africa Eats is now publicly listed (and liquid) and thus another good comparison is the public stock indecies.

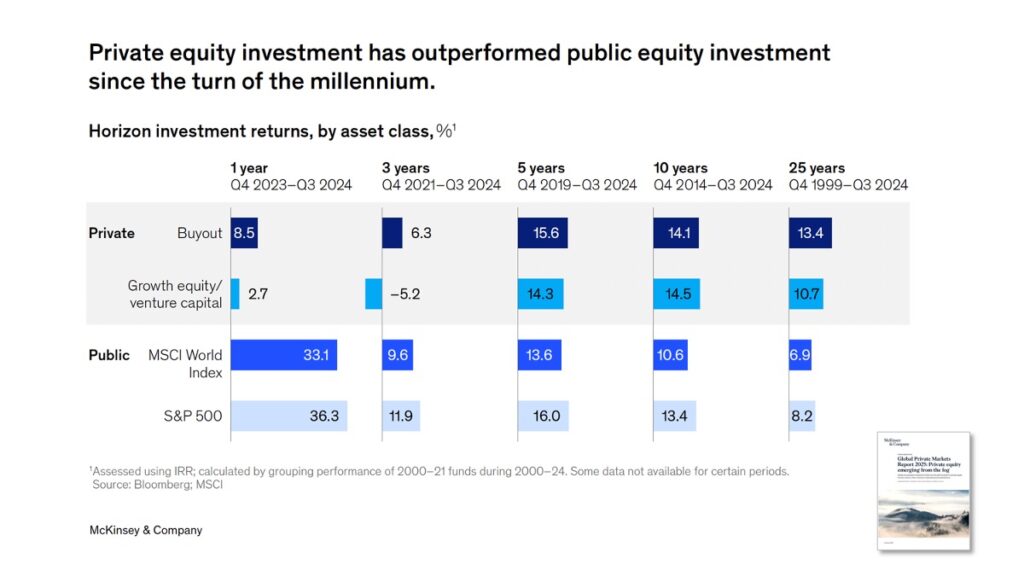

McKinsey recently published a report on “Global Private Markets” with returns over 1, 3, 5, 10, and 25 years.

Private equity is even split into two groups, the PE funds focused on buyouts and a combination of the private equity and venture capital firms focused on growth. Africa Eats is akin to the latter. For the Public equity benchmarks, McKinsey includes both the MSCI World Index and the S&P 500, with the former being more relevant to Africa Eats, as it invests outside the USA.

McKinsey must have completed the research prior to the start of 2025, which is likely why the returns are not reported as full calendar years. That should only matter for the 1 year values, which were spectacular for the public markets.

The Africa Eats values are internally computed and self-reported. The share price at incorporation, back in mid-2020 was $1.00 per share. That price increased to $1.25 in 2022, $1.65 in 2023, and $2.25 in 2024. The price remained $2.25 upon the public listing. It surpassed $2.50 in Q1 2025, but that is not reflected in the above chart, as the McKinsey values were all as of Q3 2024.

Africa Eats beat every benchmark over the last five years!

And as we like to point out, we did this while also improving the quality of lives for hundreds of thousands of smallholder farmers across Africa, and while saving thousands of tons of foods from the typical post-harvest losses. A “cake and eat it too” investment.